HECS-HELP, a program in Australia, is a two-part support system for students that combines a loan and a student discount. Here’s a breakdown of its components:

- Loan Assistance:

HECS-HELP covers your course fees if you’re an eligible student. The Australian Government directly pays the loan amount to your educational institution on your behalf.

Suggested Read: Investment Property Tax Deductions in Australia Explained

- Repayment Structure:

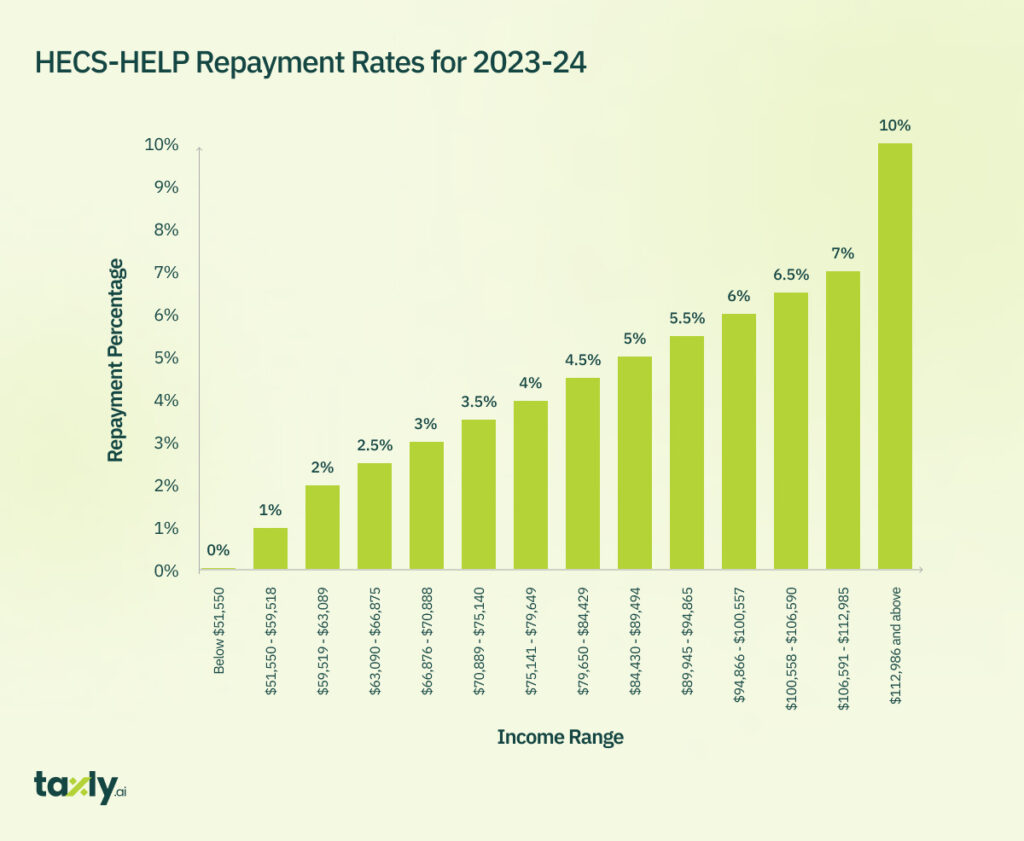

Repayments start when your income hits a specific threshold, which varies yearly. For instance, in 2022-23, the threshold was $48,361, and for 2023-24, it’s $51,550. Repayments are managed through the Australian taxation system. The percentage of repayment increases with your income, ranging from 1% to 10%.

Are You Eligible for HECS-Help?

Study Placement: You must be enrolled in a Commonwealth supported place at an eligible institution. This could be a university or an approved higher education provider.

Residency Status:

- Australian Citizens: You’re eligible.

- New Zealand Special Category Visa Holders: You must meet long-term residency requirements.

- Permanent Humanitarian Visa Holders: Eligible for HECS-HELP.

Enrollment Requirements:

- Enroll in each unit by the census date.

- Fulfill relevant HECS-HELP residency conditions.

Application Submission:

- Submit a valid Request for Commonwealth support and HECS-HELP form to your institution by the census date or earlier administrative deadlines.

Meeting these criteria allows you to access HECS-HELP, a beneficial program that assists eligible students with course fees and facilitates repayments based on income thresholds.

How is HECS-Help Treated in Tax Return?

HECS-HELP doesn’t directly impact the taxable income you report on your tax return. Instead, it’s managed separately through additional tax withholding by your employer and eventual repayments based on your income.

No Impact on Taxable Income:

The HECS-HELP loan doesn’t directly increase your taxable income. Your loan doesn’t count as income, so it doesn’t affect the tax you owe based on your earnings.

Repayments Deducted from Income:

Your employer withholds additional tax from your pay if you have a HECS-HELP debt. This is based on your Repayment Income (RI) to cover your estimated repayment.

The additional tax withheld doesn’t change your taxable income, but it helps cover your eventual HECS-HELP repayment.

Suggested Read: What Does Tax Withheld Mean in Australia?

Tax Return and HECS-HELP Debt:

When you lodge your tax return, you need to report your HECS-HELP debt. This doesn’t alter your taxable income but ensures the Australian Taxation Office (ATO) is aware of your debt.

Reconciling HECS-HELP Debt:

If the additional tax withheld by your employer didn’t cover your full HECS-HELP repayment, you might owe more when reconciling your tax return.

If too much tax was withheld, resulting in an overpayment, you’ll receive a refund after lodging your tax return.

What is HECS-Help Repayment Income (RI)?

Repayment Income (RI) is a crucial factor in determining HECS-HELP repayments in Australia. It’s a specific calculation that includes various components beyond just your taxable income. Here’s a breakdown:

What is Repayment Income?

Repayment Income (RI) includes:

- Taxable Income: This constitutes the core income you earn in a year.

- Net Investment Losses: Losses incurred from investments.

- Reportable Fringe Benefits: Certain benefits provided by your employer that you need to report.

Suggested Read: How Fringe Benefit Tax Works – All You Need to Know

- Reportable Super Contributions: Voluntary contributions made to your superannuation fund.

- Exempt Foreign Employment Income: Some income earned from foreign employment that is exempt from tax.

Suggested Read: Non-Resident Tax Australia – All You Need to Know After Moving to Australia

Why is Repayment Income Considered for HECS-HELP?

HECS-HELP repayments are income-contingent, meaning they’re linked to your ability to pay based on income levels. Including RI rather than just taxable income ensures a fair and comprehensive assessment of your financial capacity to repay your student loan.

Significance:

- Reflects Total Financial Position: RI offers a more holistic view of your financial standing by encompassing various income sources and adjustments.

- Equitable Repayment System: By considering RI, the repayment structure aligns with your overall financial circumstances, ensuring a proportional repayment based on your income capacity.

When and How to Repay HECS-Help?

Repayments for HECS-HELP commence when your income reaches a specific threshold. Here’s a clear breakdown:

Commencement of Repayments:

Repayments start once your income exceeds the minimum repayment threshold for compulsory repayment.

This threshold varies annually and is adjusted for each financial year.

Threshold for Commencing Repayments:

For the 2022-23 financial year, the minimum repayment threshold was $48,361.

For the 2023-24 financial year, it stands at $51,550.

What It Means:

When your Repayment Income (RI) surpasses these thresholds, a compulsory repayment of at least 1% of your income is raised in your income tax assessment.

The percentage of repayment increases gradually with income growth, following a progressive scale based on your earnings.

The highest rate of 10% applies to incomes surpassing the specified threshold for each financial year.

Key Point:

Repayment isn’t immediate upon graduation or completion of studies. Instead, it’s tied to your income level and begins once you start earning above the specified threshold for the relevant financial year.

Compulsory Repayments through Employer:

Employer Notification: Inform your employer about your HECS-HELP debt by ticking the relevant box on the Tax Declaration Form when you start a new job.

Additional Tax Withheld: Your employer will deduct additional tax from your pay based on your estimated HECS-HELP debt, calculated according to your Repayment Income (RI).

Important to Note:

- Your employer’s withholding may not consider all income sources, such as earnings from other jobs or investments.

- Consequently, you might need to make a supplementary payment after lodging your tax return if the withholding didn’t cover your full HECS-HELP repayment.

Voluntary Repayments:

Flexibility: You can make voluntary repayments directly to the Australian Taxation Office (ATO) at any time.

Payment Methods: Use BPAY or credit card to make these voluntary repayments.

Online Management:

Checking Debt Balance: Access the myGov portal linked to the ATO to view your HECS-HELP debt balance.

Repayment Tracking: Monitor your repayments and track the reduction of your debt through the ATO’s online services.

The Bottomline

The HECS-HELP doesn’t directly impact taxable income, but it plays a crucial role in financial planning and tax obligations due to its income-contingent repayment structure and its treatment in employer tax withholdings. Understanding these interactions ensures proper management of your HECS-HELP debt and tax implications.

Discover More Topics

Comments are closed