Every taxpayer should know how to lodge tax returns according to Australian Taxation Office guidelines. Lodging tax return on time helps you comply with the local tax regulations and enjoy peace of mind. Let’s uncover everything you need to know about how to lodge a tax return in Australia.

How to Lodge Tax Return – Key Elements to Keep in Mind

Tax Year:

In Australia, the financial year runs from 1 July to 30 June of the following year. When lodging your tax return, you will need to report your income and expenses for this specific period.

Taxable Income:

The income you earn is subject to taxes. Taxable income includes your salary, wages, business income, rental income, and other earnings. Accurately calculate your taxable income to comply with local tax regulations.

Income Tax:

Income tax is imposed on your taxable income. The Australian Taxation Office (ATO) uses a progressive tax system in which the tax rate increases with income increase. Understand the applicable tax rates and tax-free thresholds based on your income level.

Tax Refund:

If you have paid more than your actual tax liability throughout the year, you may be eligible for a tax refund according to ATO guidelines. It occurs when your employer withholds more than the required tax from your income. Lodge your tax return to claim any potential refund according to ATO.

Tax Deductions:

Tax deductions are subtracted from your taxable income and reduce your overall tax liability. Common tax deductions are work-related expenses, charitable donations, and investment costs. Keep accurate records and receipts to support your tax deduction claims.

Tax Withheld:

Tax withheld is the tax which automatically deducts from your income from your employer or payer. The government collects tax withheld as income tax throughout the year. When filing your tax return, you compare the amount of tax withheld with your actual tax liability. If you paid more tax than required, you may be eligible for a tax refund.

Remember:

The final deadline to lodge a return is 31 October following the end of the financial year.

How to Do Tax Returns in Australia?

Follow these steps for a smooth and accurate process:

Visit the ATO Website:

Visit the official Australian Taxation Office (ATO) website. Go to MyTax page to find individual tax-related information and forms. You can find the latest tax updates, guidelines, and tools to lodge your tax return.

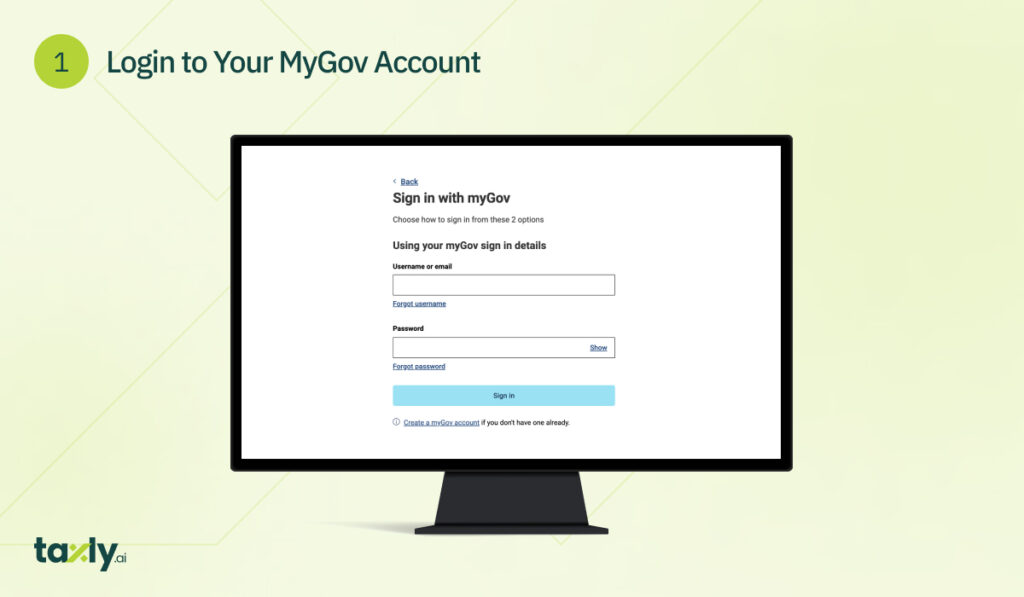

Login to Your MyGov Account:

Create or log in to your MyGov account. MyGov account gives you access to various government services such as the ATO. Link your MyGov account to the ATO to get access to your tax information so you can lodge tax online.

1. Login to Your MyGov Account

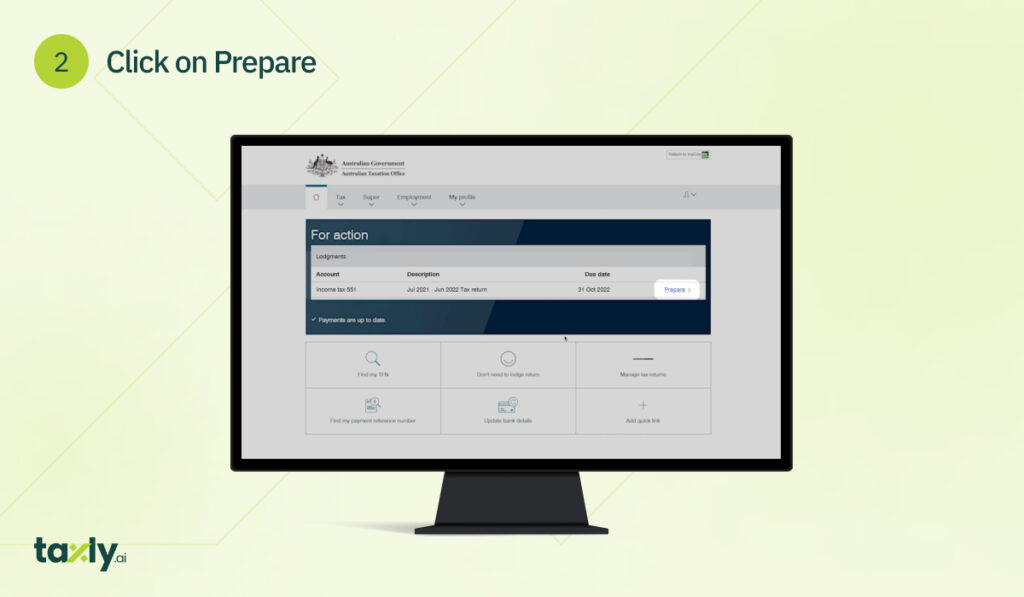

2. Click on Prepare:

3. Fill in Your Personal Details

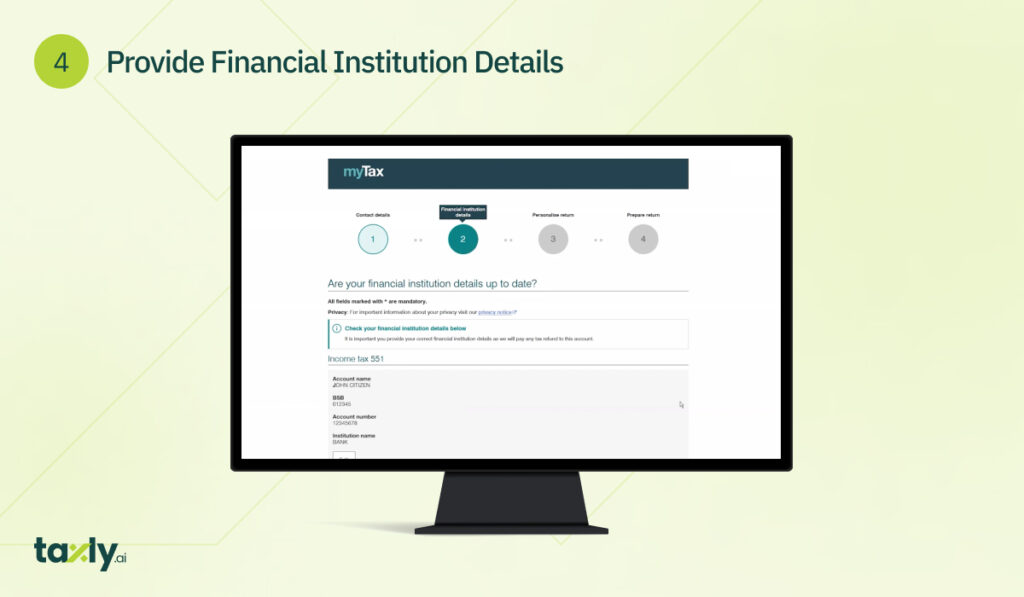

4. Provide Financial Institution Details

You will need your tax file number (TFN), employer payment summaries, bank statements, and tax deductions receipts. Gather and organize these documents beforehand to streamline the process.

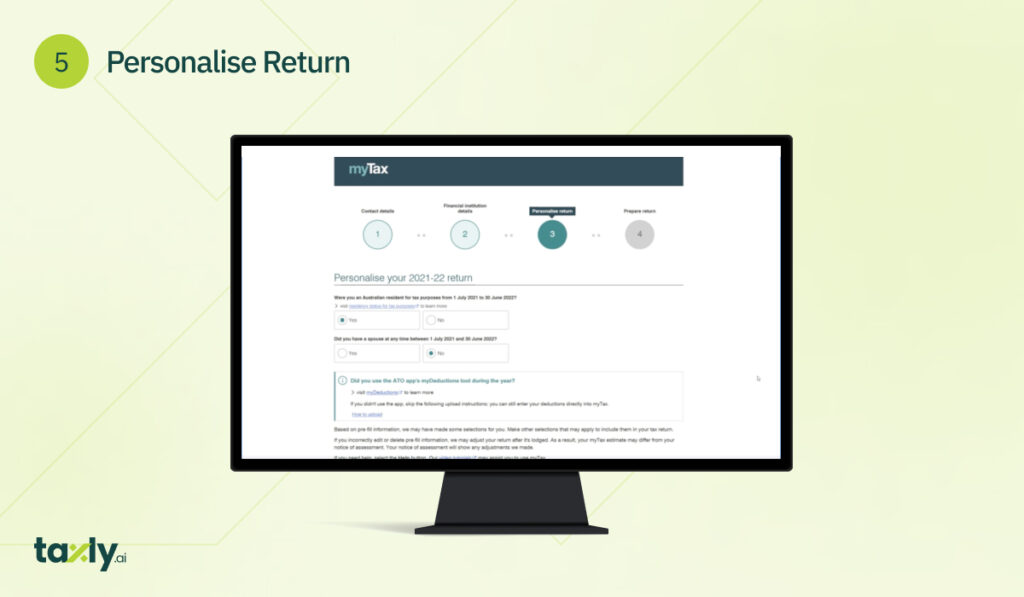

5. Personalise Return

6. Add Income Details

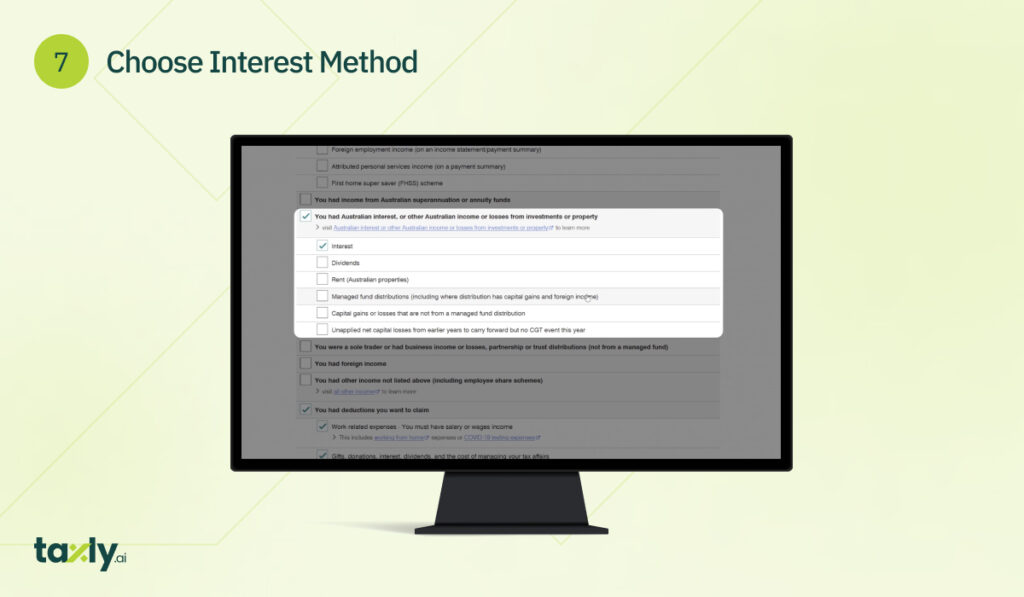

7. Choose Interest Method

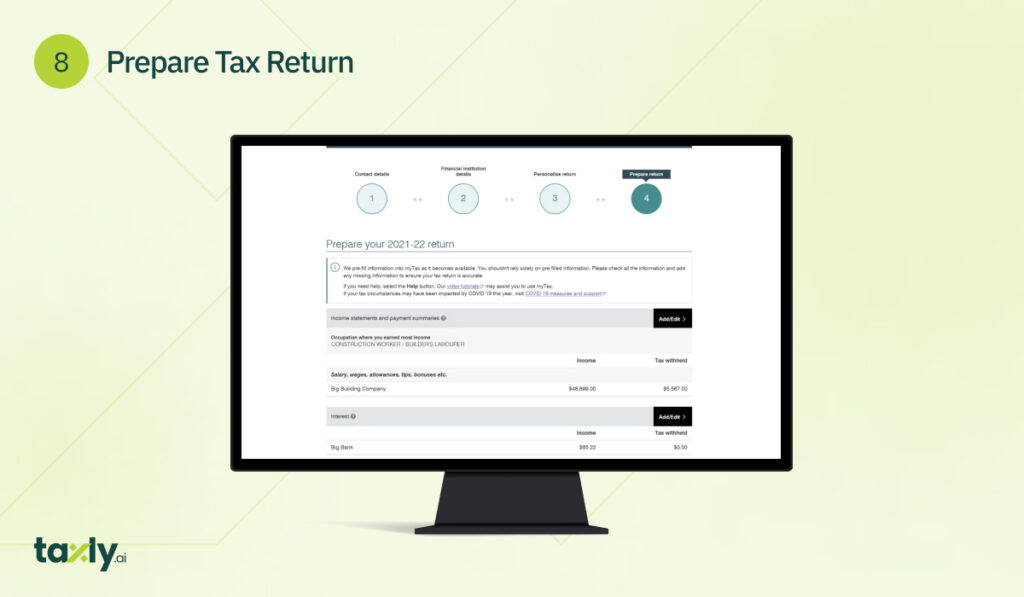

8. Prepare Tax Return

Complete the Tax Return Online:

Follow the prompts on the ATO website or the online tax return software. Provide accurate information regarding your income, deductions, and other relevant details. Double-check the data you enter to minimize errors and discrepancies.

You can also complete the tax return online using ATO Android App.

Want to avoid all the hassle? Join the AI Tax Return and Reconciliation platform for Australia.

Another Option

Alternatively, you can engage a Tax Practitioners Board (TPB) registered tax agent for professional assistance. A tax agent is a qualified professional with expertise in tax matters. They offer guidance, review your tax return, and ensure compliance with tax laws. Using a tax agent may incur a fee, but it can provide peace of mind and potentially optimize your tax outcome.

Do I need to lodge a tax return?

It depends on various factors, including your income, expenses, and personal circumstances. Here are some general guidelines to determine if you need to lodge a tax return:

Taxable Income:

If your total income before tax exceeds the tax-free threshold for the financial year, you are generally required to lodge a tax return. Keep in mind that taxable income includes salary, wages, business income, rental income, and other earnings.

Special Circumstances:

Even if your income falls below the tax-free threshold, you may still need to lodge a tax return if you:

- Had tax withheld from your income by your employer or payer?

- Received income from sources that don’t deduct tax, such as investment income.

- Were eligible for the Medicare levy but didn’t have the correct level of private health insurance coverage. Received income from overseas or have foreign assets.

- Are entitled to claim certain tax offsets or deductions.

Government Agencies Assistance:

If you received government assistance, such as JobSeeker or Parenting Payment, you may need to lodge a tax return to reconcile these payments.

Conclusion

In conclusion, lodging your tax return in Australia is a straightforward process. Connect your MyGov account to the ATO website and choose the appropriate lodgment method to lodge your return online. Keep accurate income, deductions, and other relevant details for a smoother process. Remember important tax dates and deadlines, and seek professional assistance when needed for your peace of mind.

Related Links:

Comments are closed