Are you an up-and-coming carpenter, electrician, mechanic, plumber, bricklayer, or painter? If yes, you are eligible for tax deductions. Our guide on apprentice tax deductions is everything you need to maximize your tax savings.

Long hours and hard work are part and parcel of your journey, but so should be making the most of your tax returns. Forget the old myth that as a trainee or apprentice, your tax refund options are slim – that’s just not true!

We’ve put together this guide on apprentice tax deductions to help you uncover all the tax deductions you’re entitled to. So, before you dive into your next tax return, take a moment to explore our guide. It’s time to turn those long hours into smart savings!

What can You Claim under Apprentice Tax Deductions?

Apprentice tax deductions are specific expenses that apprentices and trainees can claim on their tax returns to reduce their taxable income. These deductions are particularly relevant for those working in trades such as carpentry, electrical, plumbing, and mechanical roles, among others. Here’s a breakdown of common apprentice tax deductions:

Clothing and Protective Items:

If you need to wear branded clothing, hi-vis items, or steel-capped boots for work, these are deductible. This includes items like branded shirts with a company logo, protective boots, safety glasses, and hi-vis clothing. However, unbranded clothing like a regular pair of pants, even if compulsory for work, are not deductible.

For Example

Zoe, an apprentice painter, purchases a branded uniform (jacket and trousers) and safety goggles for $200. She also buys steel-capped boots for $150. Zoe can claim the total cost of $350 in her tax return as these items are protective and/or branded. She needs to keep receipts of these purchases for her records.

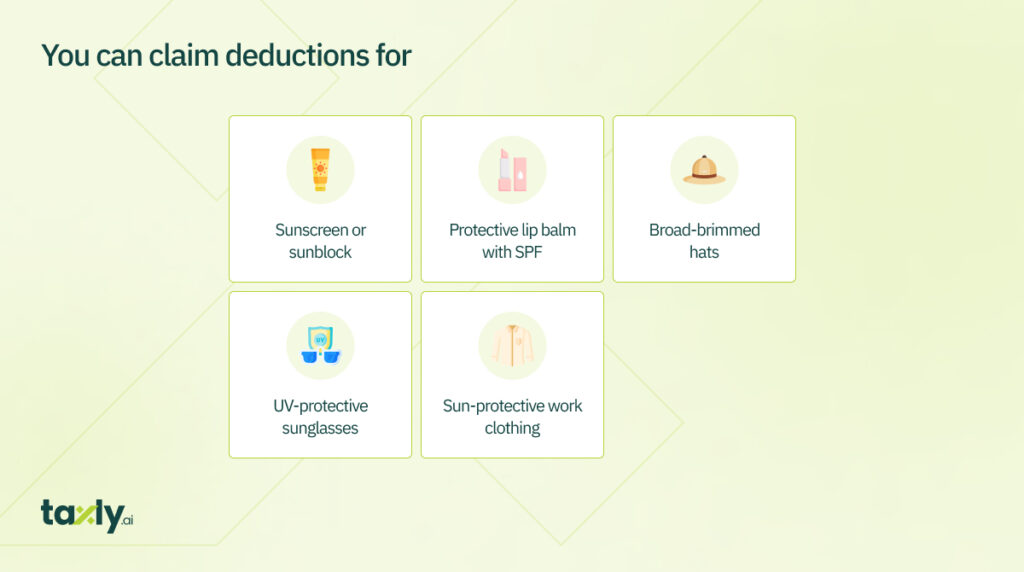

Sunscreen and Sun Protection:

For apprentices working outdoors, expenses for sunscreen, zinc, hats, or sunglasses can be claimed.

For Example

Liam, who apprentices in construction, spends $120 annually on sunscreen and $30 on a protective sun hat. Liam can claim the total $150 on his tax return. Keeping the sunscreen and hat receipts is crucial, and noting their use exclusively for work is important.

Cleaning and Laundry:

If you regularly need to wash your work clothes, you can claim a deduction for laundry expenses. Keeping track of how often you wash these clothes is essential for claiming this deduction.

For Example

Ava, training as a chef, spends $5 per week washing and ironing her chef’s uniform. Over a year (52 weeks), she spends $260 on laundry. Ava can claim this amount, and keeping a log or diary entries helps substantiate her claim.

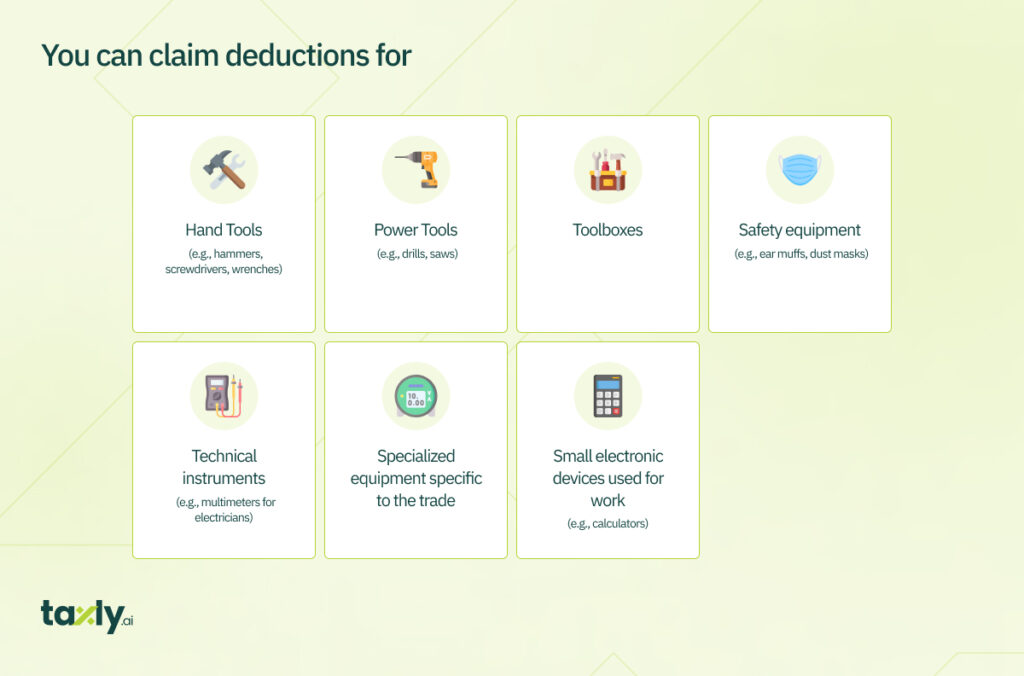

Tools and Equipment:

As an apprentice, you often need to purchase specific tools for your job. Items costing below $300 can be claimed in full, while those above $300 need to be depreciated over several years. If tools are used for both work and personal purposes, only the work-related percentage can be claimed.

For Example

Noah, an apprentice carpenter, buys a power drill for $350 and a set of chisels for $250. The chisels, under $300, can be claimed in full ($250). The drill, over $300, must be depreciated. Noah should consult the ATO’s depreciation rates or a tax professional for the correct depreciation claim.

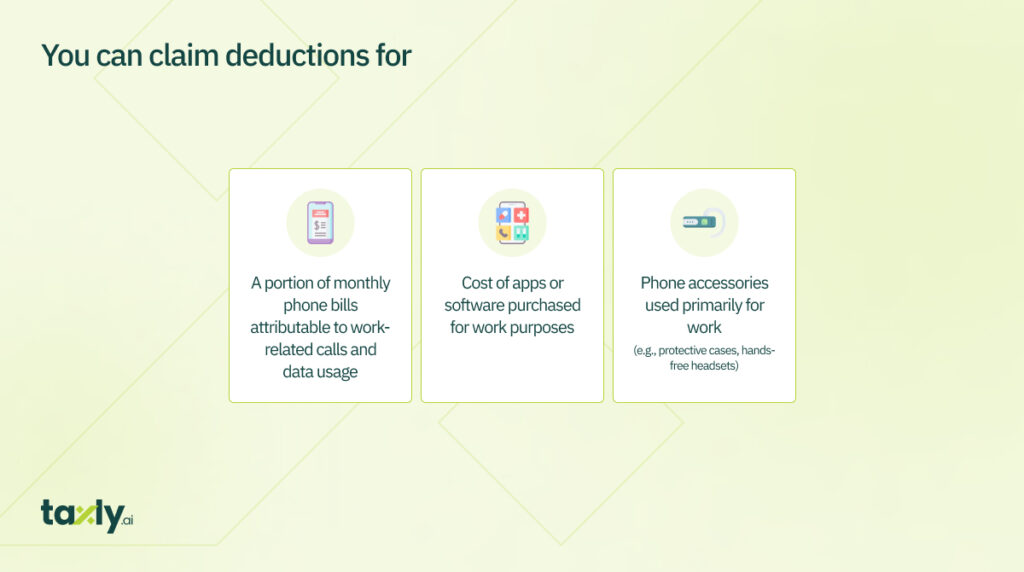

Mobile Phone Expenses:

If you use your personal mobile phone for work-related calls, a portion of the phone bill can be claimed. This requires calculating the percentage of work-related use against the total use.

For Example

Emily uses her phone for 40% work-related calls and messages. Her annual phone bill is $1200. She can claim 40% of her total bill, which amounts to $480. Keeping detailed records of work-related use (like a diary) is essential for this claim.

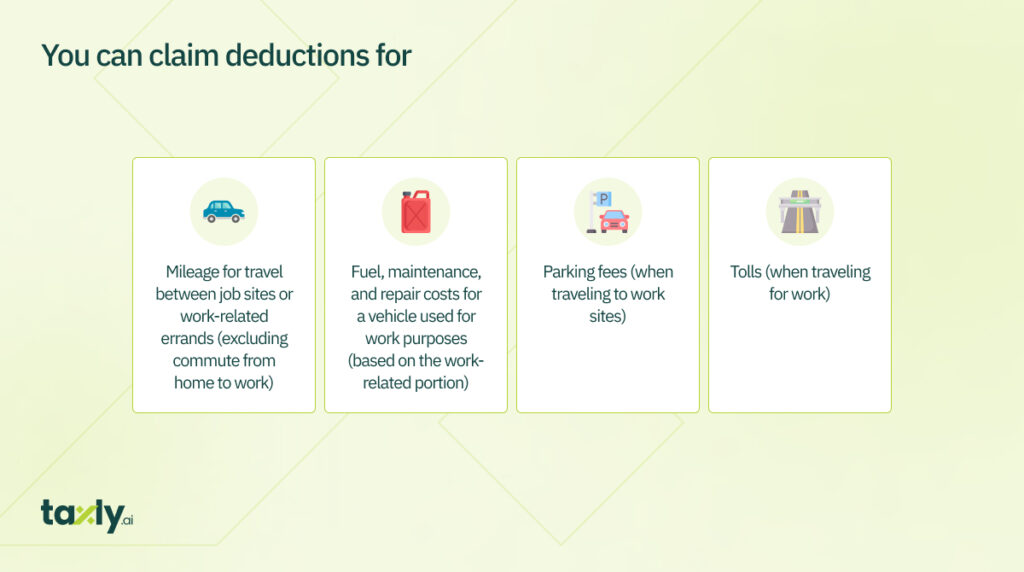

Car and Vehicle Expenses:

Apprentices who need to carry heavy or bulky tools for work, and lack a safe place at work to store them, can claim car expenses for travel between home and work. Other work-related travels, like moving between job sites or picking up supplies, are also deductible. There are specific methods to calculate this, such as the logbook method or the cents per kilometer method.

For Example

Jacob, an electrical apprentice, travels 15,000 km annually for work, which is 75% of his total car use. His total car expenses (fuel, maintenance, insurance) amount to $5,000 per year. Using the logbook method, Jacob can claim 75% of his total car expenses, equating to $3,750. He must keep a detailed logbook for 12 continuous weeks to substantiate this percentage.

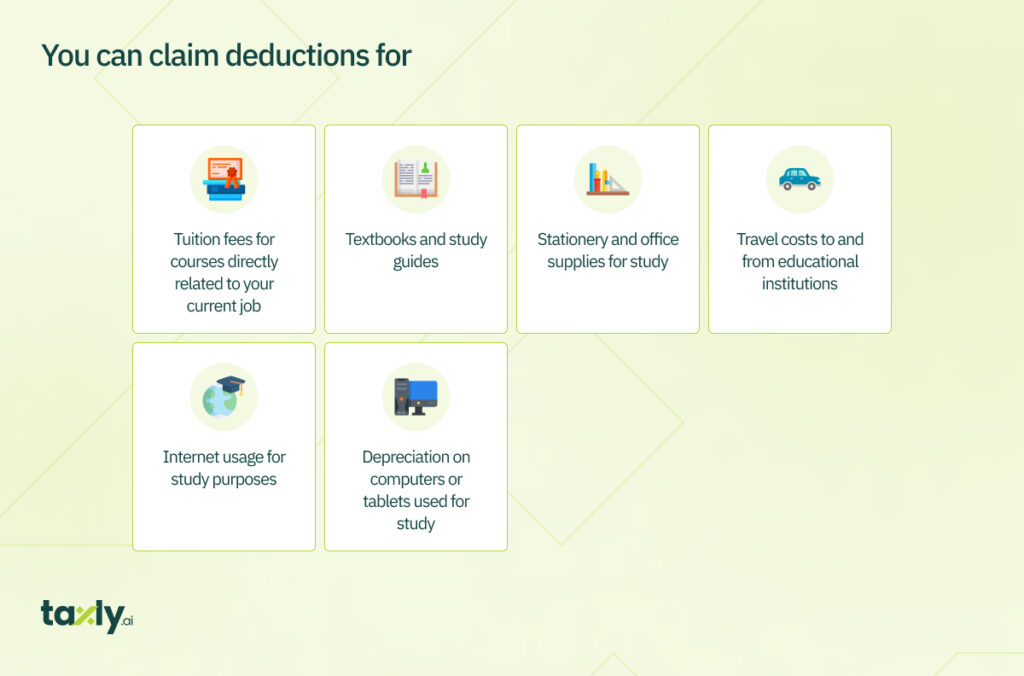

Self-Education Expenses:

If you’re engaged in education related to your apprenticeship, related expenses like textbooks, training manuals, stationery, and internet use can be claimed, provided they directly relate to your job.

For Example

Mia is undertaking a certificate course directly related to her apprenticeship, costing $1,000. She also buys $200 worth of textbooks. Mia can claim the total $1,200 on her tax return. She should keep course receipts and records of textbook purchases.

Additional Deductions

- Home Office Expenses: If you do part of your apprenticeship or training work from home, a portion of home office expenses might be claimable.

- Union or Professional Association Fees: Membership fees for unions or professional bodies related to your trade.

- Work-related Education: Seminars, workshops, and short courses directly related to your trade.

Allowances for Trainees and Apprentices

Allowances are typically extra payments made by employers to cover specific costs or compensate for certain conditions related to your work. They can include tool allowances, travel allowances, meal allowances when traveling for work, or allowances for working in difficult conditions.

Generally, allowances are considered part of your income and must be included in your tax return. This means they are taxable, and you’ll need to report them as income.

If you receive an allowance and use it for its intended purpose (like buying tools or paying for work-related travel), you can claim these expenses as deductions. However, you must have incurred the expense and it must be directly related to earning your income.

For Example: If you receive a tool allowance and use it to buy a new drill for work, you can claim the cost of the drill as a deduction.

Reimbursements for Trainees and Apprentices

Reimbursements are different from allowances. They occur when your employer pays you back for an expense you’ve already incurred. For instance, if you buy a piece of equipment and your employer pays you back the exact amount, that’s a reimbursement.

Reimbursements are not considered taxable income. This means they don’t need to be included in your tax return. Similarly, because the expense was paid back to you, you can’t claim it as a deduction.

It’s good practice to keep records and recipients of the original purchase and the reimbursement/allowances. This way, you can clearly demonstrate that the expense was reimbursed or you were paid an allowance by your employer.

Key Tips

- Include Allowances in Income: Always include any allowances received in your tax return as income.

- Deduct Eligible Expenses: You can claim deductions for expenses that you incurred in relation to an allowance, but proper documentation is crucial.

- Reimbursements Aren’t Income: Don’t include reimbursements in your income, and don’t claim the reimbursed expenses as deductions.

Apprentice Tax Deductions – FAQs

What apprentices can claim tax?

Apprentices can claim deductions for work-related expenses such as protective clothing, laundry expenses for work uniforms, tools and equipment (both under and over $300), work-related phone expenses, car expenses for travel between job sites, and self-education expenses related to their trade.

Do apprentices get taxed less?

Apprentices are taxed according to the same income tax rates as other workers. However, they may have lower taxable income due to being in the early stages of their careers. They can also reduce their taxable income through legitimate work-related deductions.

Do apprentices get a tool allowance?

Some employers provide apprentices with a tool allowance to cover the cost of purchasing necessary tools. However, this depends on the employer and the terms of the employment or apprenticeship agreement.

How do I claim tools over $300?

Tools costing over $300 must be depreciated over their effective life as specified by the Australian Taxation Office (ATO). You claim a portion of the cost each year based on the depreciation rate. Keep receipts and records of purchase to accurately calculate and claim this deduction on your tax return.

Maximize Your Apprentice Tax Refund with Taxly.Ai!

Discover how Taxly.Ai revolutionizes the way you claim tax deductions. With our cutting-edge AI technology, effortlessly identify and maximize every eligible deduction specific to apprentices and trainees. Say goodbye to missed opportunities and complicated tax filings. Join Taxly.Ai today and transform your tax return experience — ensuring you get back every dollar you deserve, quickly and easily. Start now and make your tax savings effortless with Taxly.Ai!

Comments are closed