Australians pay an extra 10% Goods and Services tax on their total purchase amount. GST applies to a variety of goods, services, businesses and consumers in Australia. In some cases, you may be eligible for GST credits. In this blog, we will break down the basics about Australian Goods and Service tax, its applicability, and your GST responsibilities.

What is Goods and Service Tax in Australia?

GST stands for Goods and Services Tax, and it’s like a ninja tax that sneaks into almost everything you buy or consume. It’s a broad-based tax on most goods, services, and other items you purchase in Australia.

What Triggers Good and Service Tax?

Physical Goods including consumer products, electronics, clothing, and more.

Services such as legal services, accounting services, consulting, plumbing, and many others.

Domestic Transactions sold and consumed within Australia.

Online Purchases from domestic and overseas sellers, depending on the items’ value.

Imports and goods brought into Australia from overseas.

Property Transactions such as the sale of new residential properties and commercial properties.

Leasing and Renting commercial properties and residential properties.

Exemptions and Special Cases: Some items, such as basic food, medical services, education, and some financial services, are exempt or subject to special rules regarding GST.

When was GST Made Applicable?

GST has been around Down Under since July 1, 2000. So, it’s been a part of Aussie life for quite a while now. You’ll find GST included in the price tags of most things you buy, like that burger you ordered or those trendy sneakers you just had to have.

How Much are we Talking About?

The GST rate in Australia is currently set at 10%. So, if you buy something for $100, $10 of that goes to the taxman as GST. It’s a flat rate, no matter what you’re purchasing.

Here are Some Examples

Sure, let’s get real with some examples. Imagine you’re shopping for a new laptop, and it’s priced at $1,000. When you reach the checkout, you’ll see that the total cost is $1,100 because of that 10% GST. So, it’s not just the laptop you’re paying for; it’s a bit of tax, too.

Now, let’s say you’re a café owner selling those delicious $5 lattes. When someone buys one, you’ll collect 50 cents in GST (10% of $5), which you later send to the Australian Taxation Office. Remember, it’s your duty as a business owner to play tax collector.

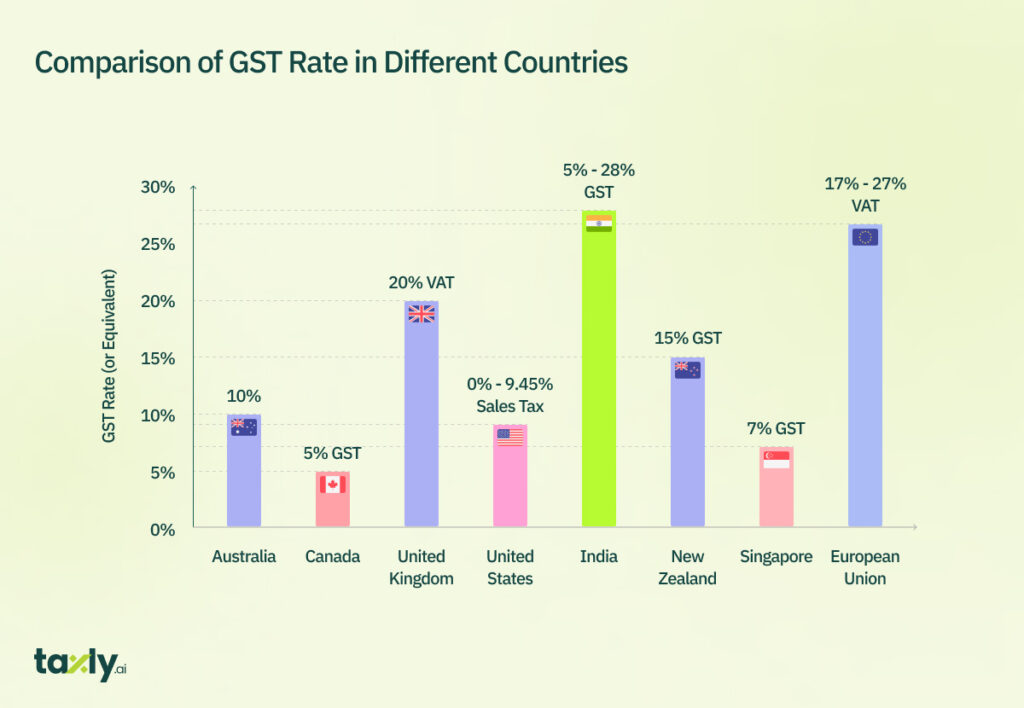

Comparison of GST Rate in Different Countries

| Country | GST Rate (or Equivalent) |

|---|---|

| Australia | 10% |

| Canada | 5% (GST) |

| United Kingdom | 20% (VAT) |

| United States | 0% – 9.45% (Sales Tax) |

| India | 5% – 28% (GST) |

| New Zealand | 15% (GST) |

| Singapore | 7% (GST) |

| European Union | 17% – 27% (VAT) |

GST-Exempt Vs GST-Free Items in Australia

Not everything you buy is hit with that 10% GST. Some goods and services are either GST-exempt or GST-free. For example, most basic food items like bread and fresh produce are GST-free, while things like healthcare and education are generally exempt. This helps keep essentials more affordable.

GST-Exempt Items

What Are They? These are specific goods and services that are not subject to the Goods and Services Tax (GST) in Australia.

Examples: Some common GST-exempt items include basic food items like bread, milk, and vegetables, as well as medical services, education, and some childcare services.

How to Identify GST-Exempt items: GST-exempt items usually fall into categories defined by the Australian Taxation Office (ATO). You can refer to the ATO’s official website or consult with a tax expert to get a comprehensive list of these items.

GST-Free Items

What Are They? GST-free items are also not subject to the GST, but they differ from exempt items in that they may still be subject to GST at an earlier stage in the supply chain (e.g., the manufacturer or distributor).

Examples: Some GST-free items include certain financial services, exports, and some medical supplies.

How to Identify Them: Similar to exempt items, you can find a list of GST-free items on the ATO’s website or consult with a tax professional for guidance.

| GST-Exempt Items | GST-Free Items |

| Basic Food (e.g., bread, milk) | Financial Services (e.g., loans) |

| Medical Services | Precious Metals (e.g., gold, silver) |

| Education Services | Exports of Goods |

| Childcare Services | Residential Rent |

| Exported Goods | International Travel Tickets |

Helpful Tips to Identify GST-Free and GST Exempt Items:

- Check the Label: Sometimes, products in stores may be clearly labeled as GST-free or exempt. This can be especially helpful when shopping for food items.

- Receipts and Invoices: If you’re uncertain, your receipts or invoices should indicate whether GST was applied or not. It’s a good practice to review these documents.

Read More: Can You Claim Deductions Without Receipts in Australia?

- Consult the ATO: When in doubt, the Australian Taxation Office is your go-to resource. They provide detailed information and guidance on GST-exempt and GST-free items.

- Professional Advice: For businesses or complex situations, consulting with a tax advisor or accountant can help ensure you’re handling GST correctly.

Can You Get a Cashback in the form of GST Credits?

Yes, you can indeed get cashback in the form of GST credits, but it’s a bit more complicated than a simple cash refund.

Here’s how it works:

GST Credits for Businesses:

If you’re a business owner registered for GST, you collect GST from your customers when they buy your goods or services. However, you also pay GST on the business-related expenses you incur. The cashback part comes in when you claim a credit for the GST you paid on those expenses.

For example:

Let’s say your business earned $10,000 from sales and collected $1,000 in GST from your customers. But during the same period, you spent $600 on GST-inclusive expenses, like buying equipment or office supplies.

You can then claim a GST credit for that $600 you paid, which effectively reduces the amount of GST you owe to the tax office. In this scenario, you’d pay $400 ($1,000 – $600) to the tax office instead of the full $1,000 you collected.

So, while it’s not exactly a direct cash refund, it does work to your financial advantage by reducing your overall GST liability, which can feel like getting some cash back.

Does GST Apply to Businesses in Australia?

Yes, GST (Goods and Services Tax) applies to businesses in Australia. If your business has an annual turnover of $75,000 or more (or $150,000 or more for non-profit organizations), you are generally required to register for GST with the Australian Taxation Office (ATO).

Here’s how it works for Australian businesses:

GST Collection

Once registered, your business must collect GST from your customers on most goods and services you sell or provide. This means that you add 10% to the price of your products or services as the GST, and that extra amount goes to the ATO.

Claiming GST Credits

The flip side is that as a registered business, you can also claim back the GST you paid on your business expenses. This includes things like office supplies, equipment, and services related to your business operations. This helps to offset the GST you collect.

Recommended Read: What is a Tax Offset? [Explained With Example]

BAS (Business Activity Statement)

To report and manage GST, you’ll need to lodge a Business Activity Statement (BAS) to the ATO regularly, typically on a quarterly basis. This statement summarizes the GST you’ve collected and the GST credits you’re eligible to claim.

BAS and PAYG

Your BAS will also include other tax-related information, such as Pay As You Go (PAYG) withholding and income tax installment payments, making it a comprehensive tax reporting tool for businesses.

Penalties for Non-Compliance

It’s important to note that failing to comply with GST obligations can result in penalties and fines. So, it’s crucial for businesses to get their GST reporting right.

Does GST Apply on Services?

Yes, GST (Goods and Services Tax) applies to services in Australia. It’s not just limited to physical goods; it also includes a wide range of services. Here’s how it works:

GST on Service Providers

If you provide services as part of your business, you are generally required to charge GST on those services. This includes professions like lawyers, accountants, consultants, and various service providers.

GST on Service Consumers

As a consumer of services, you will see GST added to the bill or invoice when you use a service that is subject to GST. This means you will pay 10% extra on top of the service’s price as GST.

Examples of Taxable Services

Taxable services that are subject to GST include legal advice, accounting services, architectural and engineering services, consultancy, IT services, and many others.

Service providers can claim GST credits for the GST they pay on business-related expenses. They must report and remit the GST they’ve collected from their clients on their Business Activity Statements (BAS) to the Australian Taxation Office (ATO).

Do Work from Home Individuals and Freelancers Pay GST?

GST can apply to freelancers and individuals who work from home in Australia, depending on their specific circumstances and the nature of their work. Here’s how GST may affect freelancers and home-based workers:

Freelancers Providing Services

If you work as a freelancer and provide services such as writing, graphic design, web development, consulting, or any other service, you may be required to register for GST if your annual turnover reaches or exceeds $75,000 (or $150,000 for non-profit organizations). This means you must charge GST to your clients on top of your service fees.

Registered freelancers need to report and remit the GST they collect from their clients on their Business Activity Statements (BAS) to the Australian Taxation Office (ATO) on a regular basis.

The good news is that as a registered freelancer, you can also claim GST credits for the GST you pay on business-related expenses, such as computer equipment, software, office supplies, and other work-related costs.

Read More:

- Your Complete Guide to Work Related Business Trip Tax Deduction

- Self Employed Vs Freelance Tax – Key Things to Know

Home Office Expenses

If you work from home, you may be able to claim a portion of your home office expenses as a tax deduction. This can include expenses like rent or mortgage interest, electricity, internet, and phone bills, provided they are related to your work.

Suggested Read: Work from Home Tax Deduction In Australia: Check Your Eligibility

Annual GST Turnover

Keep in mind that if your annual GST turnover is below the threshold, you are not required to register for GST, and you do not have to charge GST to your clients. However, you also cannot claim GST credits for the expenses you incur.

Consult with a Tax Professional

Freelancers and individuals working from home may have unique tax situations, and it’s advisable to consult with a tax professional or accountant to ensure compliance with GST regulations and to maximize available deductions.

Does GST Apply on Online Shopping?

Yes, GST (Goods and Services Tax) can apply to online shopping in Australia, including purchases from both domestic and overseas online retailers. Here’s how it works:

Domestic Online Shopping

When you buy goods or services from Australian online retailers, the prices typically include GST, just like when you shop at a physical store. So, when you check out, you’ll see the GST component included in the total price.

Overseas Online Shopping

If you purchase items from overseas online retailers and the value of those items is $1,000 or less, you may still be required to pay GST. The GST is generally collected by the seller or included in the price you pay. Some overseas sellers may even require you to pay the GST separately at the time of purchase.

Customs and Import GST

For items with a value above $1,000, customs duties and import GST may apply when the items arrive in Australia. You might need to pay these taxes to customs before your package is released to you.

Tourist Refund Scheme

If you’re a tourist visiting Australia and you buy items worth $300 or more, you might be eligible to claim a refund for the GST you paid when leaving the country. This is part of the Tourist Refund Scheme (TRS).

Online Marketplace Facilitators

In some cases, online marketplaces like eBay and Amazon are responsible for collecting and remitting GST on behalf of overseas sellers. This ensures that the GST is paid when you purchase items through these platforms.

Awareness and Compliance

Online shoppers should check the seller’s policies and the item’s price breakdown to understand whether GST is included and how it is handled.

Is GST Applicable on Tourists in Australia?

If you’re a tourist visiting Australia and you buy something worth $300 or more, you might be able to claim a refund for the GST when you leave the country. So, keep those receipts handy if you plan on doing some serious souvenir shopping.

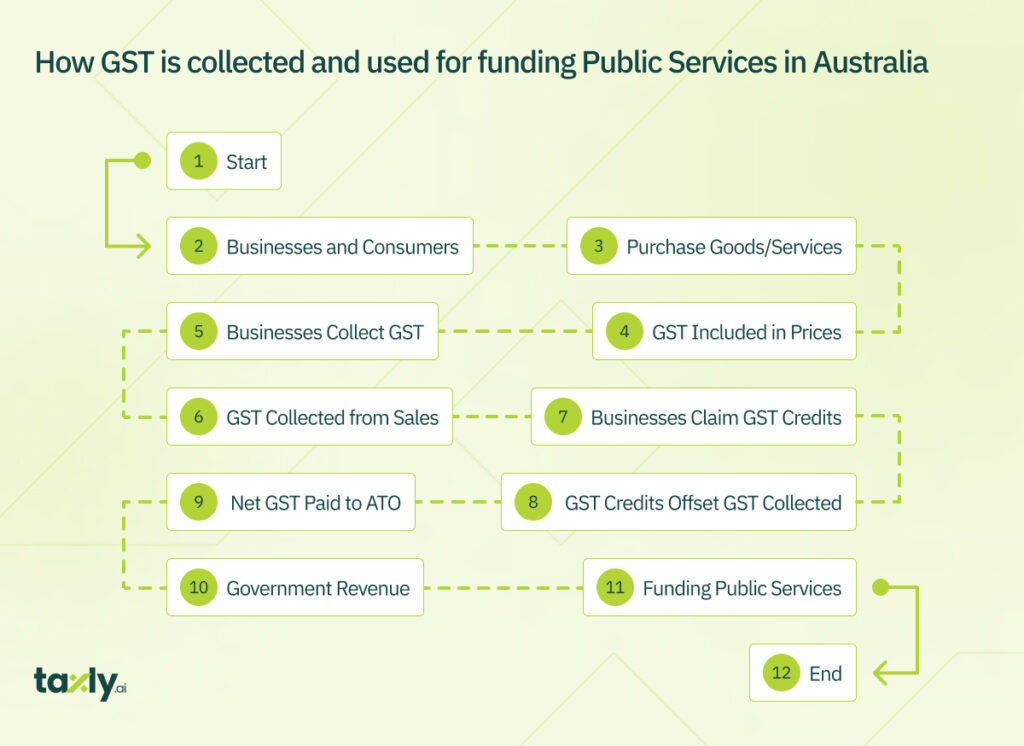

How does GST Contribute to Government Revenue?

GST is one of the major revenue sources for Australian government. It funds essential healthcare, education, and infrastructure. So, even though paying GST feels like extra spending, it actually beneficial for running the country.

In a Nutshell

GST in Australia is a 10% tax on most goods and services. It’s applicable on almost everything you buy and sell in Australia. Although it may seem like excessive financial burden, GST funds essential public services and it is good for the overall economy.

Continue Your Exploration:

- 10 Self-Employment Tax Deductions and Benefits for Australians

- What is Marginal Tax Rate in AU – [FY 2023-24] Complete Guide

- How do I Find my Tax File Number in Australia?

Reference:

[1] Register for goods and services tax (GST) – Business AU

[2] GST and consumers – ATO

Comments are closed